Commodity Watch Article

The Ulster Farmers’ Union's Dairy committee has decided to reinstate its Milk Price Indicator (MPI).

This was originally launched in 2013, in light of an absence of milk pricing data specific to Northern Ireland, published fortnightly, with supporting market analysis, it gave dairy farmers an indication of returns from key commodity markets. Publication was suspended in late 2014 after claims it was talking down milk prices, claims which were subsequently proved wrong with the continued calculation of the MPI accurately reflecting market returns and the milk price in Northern Ireland.

Background to the MPI

The UFU MPI was originally launched in May 2013. At the time, the UFU stressed it should be viewed as an indicative pence per litre figure of what we believed that dairy markets could return. Exposure to dairy commodity prices meant that figures were quoted in tonnes and kilogrammes and the MPI was a first in Northern Ireland as it provided a pence per litre indicator of what markets could return. It should be stressed that the MPI is not necessarily what the farm-gate milk price should be nor the price that a farmer should receive, rather it is an indication as to market movements and what the market is returning.

MPI Structure

The reinstated MPI will remain unchanged in how it is calculated. The UFU MPI is based upon a basket of commodities relevant to Northern Ireland; Cheese; Whey Powder; Butter, Skimmed Milk Powder and Whole Milk Powder. The indicator itself is a hybrid of the industry recognised AMPE (Actual Milk Price Equivalent) and the MCVE (Milk for Cheese Value Equivalent) calculations. There is a time lag associated with the MPI since it I composed of an element of spot prices and this should be considered.

The MPI not include transport charges and does not factor in processor margin. The impact upon the MPI of these added costs is debatable especially when you consider that in late 2013, Dairy Co/AHDB commissioned a review of the long standing milk price indicators, AMPE and MCVE. The recommendations questioned the inclusion of profit margin and transport costs within AMPE and MCVE.

MPI Publication Suspended

The decision was made reluctantly to suspend the publication of the MPI in September 2014, due to unfounded fears raised by some in the industry that the MPI was talking down the price of milk in Northern Ireland, when in fact we were in the middle of toxic combination of factors which created major downward pressure on milk prices.

Comparison

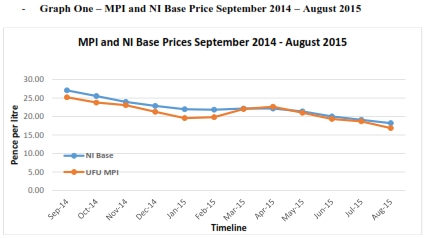

Graph One illustrates how the MPI has performed in the 12 months after its suspension. During this time, the MPI fell by 33%. The Northern Ireland base milk price fell from 25p per litre to 17.74ppl, which was a fall of 29%.

Graph One – MPI and NI Base Price September 2014 – August 2015

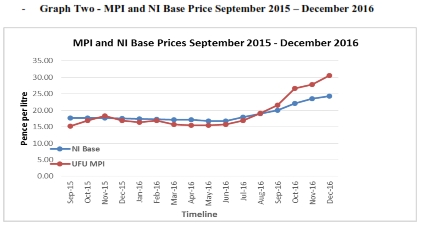

It is important to note that the period shown within Graph Two below, for September 2015 to August 2016, base price average was 16.04ppl and for this 12 month period, an indication of the severe pressure our sector was under. Meanwhile the average MPI for this period was 16.59ppl.

Graph Two – MPI and NI Base Price September 2015 – December 2016

Why are the UFU reinstating the MPI?

The MPI has been running ever since its publication was suspended. During this time, the local dairy market has grown ever more volatile in the last 12 months, take Brexit for example. The correction in Sterling exchange rates has added 3ppl to the price of milk, and never more so than now do local farmers need an indictator as to what milk commodity markets are returning and the direction of prices.

Commitment to the long term

The UFU Dairy Committee are committed to the continued publication of the MPI. Such is the volatile nature of dairy markets, prices will inevitably weaken, but we would like to stress and reassure our members that the MPI is here to stay and will be of benefit to the dairy sector in Northern Ireland.

Where will the MPI be published?

The MPI will be published in graphical form on a fortnightly basis, accompanied by analytical commentary in UFU Watch (Farming Life), UFU member bulletin and via UFU outlets on social media; Facebook etc.

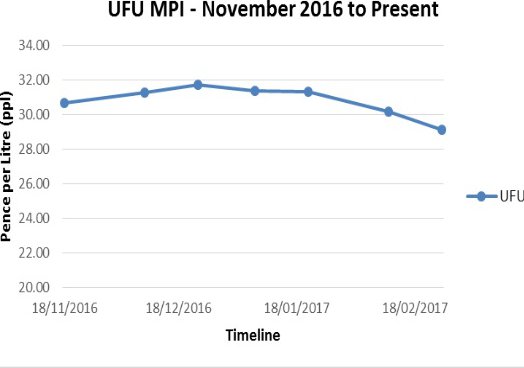

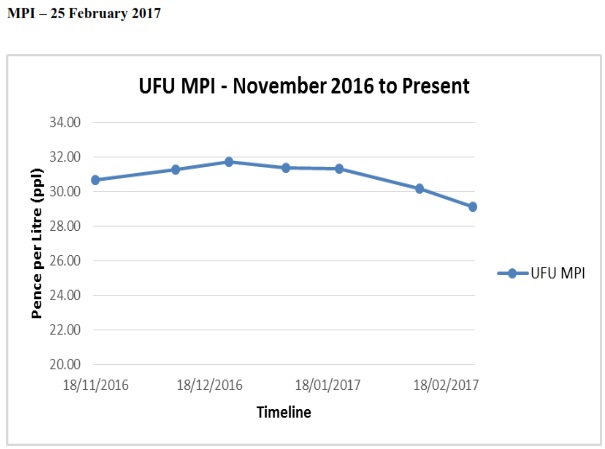

The reinstated MPI at the 25th February 2017 is:

Analysis

Latest MPI is 29.12ppl. In the last 3 months, the UFU MPI has been over 30ppl. Higher price was buoyed by reducing milk volumes but also demand was higher as a result of increased orders for butter and cream. Since the New Year milk production has risen (in line with seasonal increases) and butter prices have fallen back, but Dutch Dairy Board (ZuivelNL) still trading c.€4,000/tonne.

The latest GDT auction in New Zealand saw Price Index down 3.2%, with WMP down 3.7% to $3,189/tonne. This was expected with increased volume available. Meanwhile, on Wednesday, the Dutch Dairy Board/Zuivel saw mixed results, butter was up for the second consecutive week, up €50 to €4,050/tonne but powders all fell. Industry keeping a close eye on SMP in EU Intervention stores.